Did you know that the average American carries over $38,000 in personal debt? With such a significant financial burden, finding the most effective debt payoff strategy is crucial. One popular method that has helped countless individuals become debt-free is the debt snowball method.

The debt snowball method involves organizing debts from smallest to largest balance and focusing on paying off the smallest debt first while making minimum payments on the others. This approach provides psychological motivation and a sense of progress, as individuals experience small wins along the way.

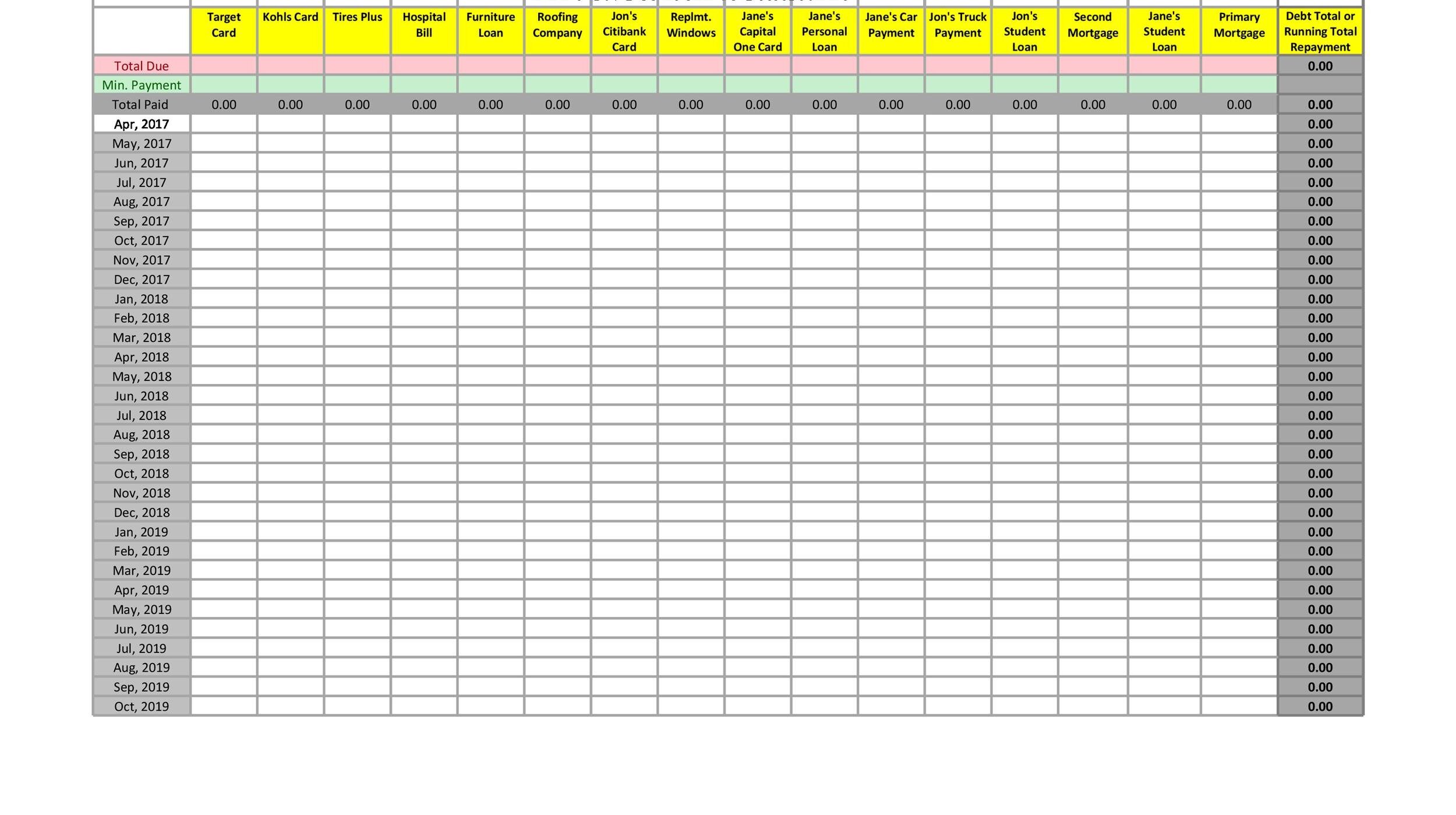

If you’re looking to optimize your debt repayment and track your progress, using a free debt avalanche spreadsheet can be a game-changer. These spreadsheets, available for Excel and Google Sheets, offer features such as tracking balances, interest rates, minimum payments, and projected payoff dates. With customization options to fit your financial situation and goals, they become valuable tools for your debt repayment journey.

Key Takeaways:

- An average American carries over $38,000 in personal debt.

- The debt snowball method involves paying off debts from smallest to largest balance.

- Free debt avalanche spreadsheets for Excel and Google Sheets can help optimize debt repayment.

- These spreadsheets track balances, interest rates, minimum payments, and projected payoff dates.

- Customizable features make these spreadsheets valuable tools for managing and tracking debt repayment progress.

Best Free Debt Snowball Spreadsheets for Excel and Sheets

Several free debt snowball spreadsheets are available for Google Sheets and Excel that can aid in organizing and managing debt repayment. One example is Tiller’s Debt Payoff Planner, which automatically tracks credit card balances and loans in one dashboard and offers tools for creating a custom payoff strategy. This spreadsheet shows current balances, interest rates, minimum payments, and progress towards debt payoff goals.

Another option is the Debt Payoff Calculator for Google Sheets, which allows users to plan the best debt payment strategy based on their current financial situation. There are also debt snowball spreadsheet templates available on platforms like Reddit and Vertex42, offering simple and customizable tracking of debt repayment progress. These spreadsheets can help individuals calculate monthly payment amounts, track interest paid, and estimate payoff dates, providing valuable insights for optimizing debt repayment.

Comparison Table: Debt Snowball Spreadsheet Options

| Spreadsheet | Key Features | Compatibility |

|---|---|---|

| Tiller’s Debt Payoff Planner | Automatically tracks credit card balances and loans in one dashboard, offers tools for creating a custom payoff strategy | Google Sheets and Excel |

| Debt Payoff Calculator for Google Sheets | Allows users to plan the best debt payment strategy based on their current financial situation | Google Sheets |

| Reddit and Vertex42 Templates | Simple and customizable tracking of debt repayment progress | Google Sheets and Excel |

Choosing the Right Debt Payoff Method: Snowball vs Avalanche

When it comes to paying off debt, individuals often find themselves faced with the decision between the debt snowball method and the debt avalanche method. The debt snowball method involves prioritizing debts from the smallest to the largest balance, while the debt avalanche method focuses on tackling debts with the highest interest rate first.

The debt snowball method offers a sense of accomplishment and motivation by allowing individuals to pay off smaller debts quickly. By experiencing these tangible wins, individuals can build momentum and stay motivated throughout their debt repayment journey. On the other hand, the debt avalanche method may result in more savings in interest payments over the long term, as it prioritizes debts with higher interest rates.

The choice between these two methods ultimately depends on individual preferences and financial goals. For some individuals, the small wins associated with the debt snowball method provide the motivation and encouragement they need to stay committed. Others may prioritize minimizing interest payments and opt for the debt avalanche method to save more money in the long run.

To make an informed decision, individuals can utilize a debt reduction tracker or calculator. These tools can help compare the impact of each method on specific debts, providing insights into the projected payoff dates, interest savings, and overall progress. By using a debt avalanche calculator or a debt reduction tracker, individuals can evaluate which method aligns better with their financial situation and goals, ultimately choosing the approach that suits them best.

FAQ

What is the debt snowball method?

The debt snowball method is a debt payoff strategy that involves listing all debts, ordering them from smallest to largest balance, and focusing on paying off the smallest debt while making minimum payments on the others.

How does the debt snowball method help with debt repayment?

The debt snowball method provides psychological motivation and a sense of progress, which can improve debt repayment outcomes. It allows individuals to start small and gain momentum over time until they are debt-free.

Are there free debt snowball spreadsheets available for Excel and Google Sheets?

Yes, there are many free debt snowball spreadsheets available that can help individuals plan and track their debt repayment progress. These spreadsheets can be customized to fit individual financial situations and goals.

Can you recommend any specific free debt snowball spreadsheets for Excel and Google Sheets?

Some recommended options include Tiller’s Debt Payoff Planner, which automatically tracks credit card balances and loans in one dashboard, and the Debt Payoff Calculator for Google Sheets, which allows users to plan the best debt payment strategy based on their current financial situation. There are also templates available on platforms like Reddit and Vertex42 that offer simple and customizable tracking of debt repayment progress.

What is the difference between the debt snowball method and the debt avalanche method?

The debt snowball method involves paying off debts from smallest to largest balance, while the debt avalanche method focuses on paying off debts with the highest interest rate first. The snowball method provides tangible wins and a sense of accomplishment, while the avalanche method may save more money in interest payments over the long term.

How do I choose between the debt snowball method and the debt avalanche method?

The choice between the two methods depends on individual preferences and financial goals. Some individuals may find motivation in the small wins of the snowball method, while others may prioritize minimizing interest payments through the avalanche method. Using a debt reduction tracker or calculator can help individuals compare the impact of each method on their specific debts and make an informed decision.